Fed rate cut

January 31, 2008

Source: http://www.econbrowser.com/archives/2008/01/fed_rate_cut.html

January 30, 2008

Fed rate cut

by James Hamilton

Today the Federal Reserve announced a further 50-basis-point cut in its target for the fed funds interest rate, bringing it down to 3.0% for a total reduction in January of 125 basis points. How long should it take before this has an effect on the economy?

In a recent research paper I sought to develop new measures of the time delays between when the Fed acts and when the effects are felt on the economy. I produced evidence that policy changes begin to affect the economy as soon as they are anticipated by markets, usually well in advance of when the Fed actually announces that its target has changed. If nothing else, the excitement this last month gives us some wonderful new evidence to illustrate this.

In December, the Fed's target interest rate still stood at 4.25%. The graph below plots the expected average value for the fed funds rate for February or March as implied by the closing values of the February or March fed funds futures contract as of each day over the last month. At the start of January, traders were anticipating that we'd see a 25-basis-point cut by the end of the month, or an expected funds rate of 4%. There was a gradual process over the month of revising these expectations down as the month progressed. By January 13, the betting was starting to anticipate a 75-basis-point cut, and by January 22, the market was anticipating close to 3% by month's end, as was indeed announced today.

My research paper presented evidence that a move like this would begin to affect mortgage rates as soon as it becomes anticipated by markets. The graph below replicates the calculations from Figure 7 of my paper (which looked at the summer of 2006) for the new numbers for January 2008. The green line indicates how the 30-year mortgage rate would have been expected to move along with changing anticipations of the February and March fed funds rates based on the parameter values that I estimated in that paper using 1988-2006 data. The blue line records the actual change. My model would have predicted a cumulative decline in mortgage rates of 66 basis points during the month of January, virtually identical to what we observed.

My research paper went on to demonstrate that although interest rates respond immediately to the anticipation of any change from the Fed, it takes a considerable amount of time for this to show up in something like new home sales, due to the substantial time lags involved for most people's home-purchasing decisions. The graph below gives my estimate of the average time delay between a change in the mortgage rate and a subsequent change in the number of new home sales. According to the historical correlations, we would expect the biggest effects of the January interest rate cuts to show up in home sales this April.

But of course, this is just focusing on one determinant of home sales (the interest rate), and there are a number of other factors that have been playing a bigger role over the last year. Tightening lending standards rather than the interest rate have in my opinion been the biggest explanation for why home sales continued to deteriorate after January 2007 and for the acceleration of that trend following the credit problems in August.

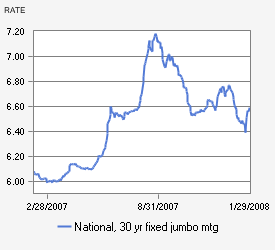

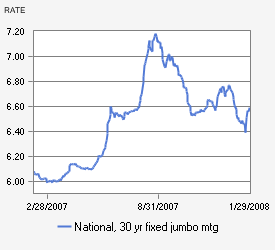

One indicator of the role of the credit crunch in the housing market is the fact that, although we have seen the interest rate on conventional 30-year mortgages decline dramatically over the last six months, the rate on jumbo loans (those too big to qualify for securitization by Fannie or Freddie) remains well above where it stood a year ago.

The effect of rising unemployment and expectations of falling house prices on housing demand is another big and potentially very important unknown.

Still, it is hard to imagine that the latest actions by the Fed would fail to have a stimulatory effect. We've already seen a big surge in mortgage applications, though this is much more in evidence for the Mortgage Bankers Association index of refinancing applications

than in their Purchase Index:

My bottom line: the Fed's moves this month have to help relative to where we would have been without them, but it will take some time to see by how much. If indeed a recession began in December (and I repeat that no one knows for sure whether or not it did), things are going to get worse before they get better.

January 30, 2008

Fed rate cut

by James Hamilton

Today the Federal Reserve announced a further 50-basis-point cut in its target for the fed funds interest rate, bringing it down to 3.0% for a total reduction in January of 125 basis points. How long should it take before this has an effect on the economy?

In a recent research paper I sought to develop new measures of the time delays between when the Fed acts and when the effects are felt on the economy. I produced evidence that policy changes begin to affect the economy as soon as they are anticipated by markets, usually well in advance of when the Fed actually announces that its target has changed. If nothing else, the excitement this last month gives us some wonderful new evidence to illustrate this.

In December, the Fed's target interest rate still stood at 4.25%. The graph below plots the expected average value for the fed funds rate for February or March as implied by the closing values of the February or March fed funds futures contract as of each day over the last month. At the start of January, traders were anticipating that we'd see a 25-basis-point cut by the end of the month, or an expected funds rate of 4%. There was a gradual process over the month of revising these expectations down as the month progressed. By January 13, the betting was starting to anticipate a 75-basis-point cut, and by January 22, the market was anticipating close to 3% by month's end, as was indeed announced today.

My research paper presented evidence that a move like this would begin to affect mortgage rates as soon as it becomes anticipated by markets. The graph below replicates the calculations from Figure 7 of my paper (which looked at the summer of 2006) for the new numbers for January 2008. The green line indicates how the 30-year mortgage rate would have been expected to move along with changing anticipations of the February and March fed funds rates based on the parameter values that I estimated in that paper using 1988-2006 data. The blue line records the actual change. My model would have predicted a cumulative decline in mortgage rates of 66 basis points during the month of January, virtually identical to what we observed.

My research paper went on to demonstrate that although interest rates respond immediately to the anticipation of any change from the Fed, it takes a considerable amount of time for this to show up in something like new home sales, due to the substantial time lags involved for most people's home-purchasing decisions. The graph below gives my estimate of the average time delay between a change in the mortgage rate and a subsequent change in the number of new home sales. According to the historical correlations, we would expect the biggest effects of the January interest rate cuts to show up in home sales this April.

But of course, this is just focusing on one determinant of home sales (the interest rate), and there are a number of other factors that have been playing a bigger role over the last year. Tightening lending standards rather than the interest rate have in my opinion been the biggest explanation for why home sales continued to deteriorate after January 2007 and for the acceleration of that trend following the credit problems in August.

One indicator of the role of the credit crunch in the housing market is the fact that, although we have seen the interest rate on conventional 30-year mortgages decline dramatically over the last six months, the rate on jumbo loans (those too big to qualify for securitization by Fannie or Freddie) remains well above where it stood a year ago.

The effect of rising unemployment and expectations of falling house prices on housing demand is another big and potentially very important unknown.

Still, it is hard to imagine that the latest actions by the Fed would fail to have a stimulatory effect. We've already seen a big surge in mortgage applications, though this is much more in evidence for the Mortgage Bankers Association index of refinancing applications

than in their Purchase Index:

My bottom line: the Fed's moves this month have to help relative to where we would have been without them, but it will take some time to see by how much. If indeed a recession began in December (and I repeat that no one knows for sure whether or not it did), things are going to get worse before they get better.

Labels: Articles, Fundamentals